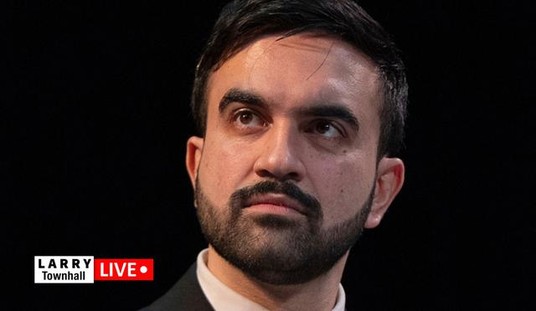

Larry Summers, former Secretary of Treasury under Bill Clinton and economic adviser to Barack Obama, said he is “more worried” about inflation following July’s jobs report. The most recent consumer price index shows inflation at 9.1 percent in June, the highest since 1981.

Regarding the July jobs report, Summers said:

“I’m more worried about inflation tonight than I was last night … And I think it’s misleading not to see things that way.”

The economist continued, telling CNN:

“There’s nothing in this report to suggest that we’re getting inflation under control — rather the opposite … Look, it’s always welcome news when people are getting jobs.”

CNN’s Wolf Blitzer pushed back, stating that the United States regained jobs lost during the COVID-19 pandemic. Summers responded:

“It’s welcome news when wages are going up. But I have to say, I don’t think it’s quite as rosy as your report suggested … The principal problem of the economy for some time has been inflation.”

Summers previously suggested that the unemployment rate must rise for high costs of products to fall. He also mentioned that although wages are up, they are still behind the inflation rate. He told Yahoo Finance that the unemployment rate “could cross six percent” in two or three years.

Former Treasury Secretary Larry Summers joined Yahoo Finance Live to weigh in on #inflation, #unemployment and the likelihood of a U.S. #recession. pic.twitter.com/ZG3UE5ieUO

— Yahoo Finance (@YahooFinance) August 5, 2022

Summers said:

“Yes, wages did go up half a percent last month. But that’s about a 6% annual rate, and inflation has run at about 9% over the last year. I think our core problem, which is that we have an unsustainably overheated economy that’s leading to high inflation, which is cutting people’s paychecks, that, unfortunately, has not been addressed by the news in this report … So, I’m glad to see it, and it brings good news to a large number of families. But I’m afraid we’re still in the kind of unbalanced situation that you and I have been talking on — talking about on this show for quite a long time.”

He noted that July’s jobs report would make it difficult for the Federal Reserve to accomplish a “soft landing.” The so-called “soft landing” means the Federal Reserve will raise interest rates while avoiding guiding the economy into a recession.

Summers continued:

“[W]hen you’ve got large numbers of vacancies, which we still do, when you’ve got such a labor shortage, which we still have, when you have wages going up rapidly in dollar terms, but not in purchasing power terms because prices are going up faster, you’re getting more and more of a cycle … And that’s making engineering the proverbial soft landing that much harder for the Fed.”

Summers added that he believes the economy is headed for a recession due to “the fundamental challenge that the economy faces is a kind of overheating, and this just shows that we’re overheating more.”

Join the conversation as a VIP Member