Sometimes when you do a post and it has two different distinct points in it, you occasionally want to do a follow-up on one of them to drill down a bit more. This turned out to be the case with the offering that I had yesterday here on RedState, where I was bringing up two separate issues that I believe won't change no matter who is elected the next Speaker of the House.

One of those things is what happens when the House and Senate pass bills that are totally separate, and they have to come together in a process called reconciliation. The other part is when politicians talk about how worried they are about the debt and the enormous amount of deficit spending that we're doing, yet neglect to mention the looming crisis of entitlement programs.

The second part is what I want to focus on here today. I also did a bit yesterday on my Facebook Live, which you can view here here.

Here's a portion from my post yesterday: Get Ready to Hate Whoever the Next Speaker Is

The End of Debt and Deficit Spending

Believe it or not, the last time we technically had a balanced budget in this country was during the time of Bill Clinton and Newt Gingrich. Now of course I still think they did some budget trickery to do it, but there was no question that money coming in was closer to money going out, much closer than it is today.

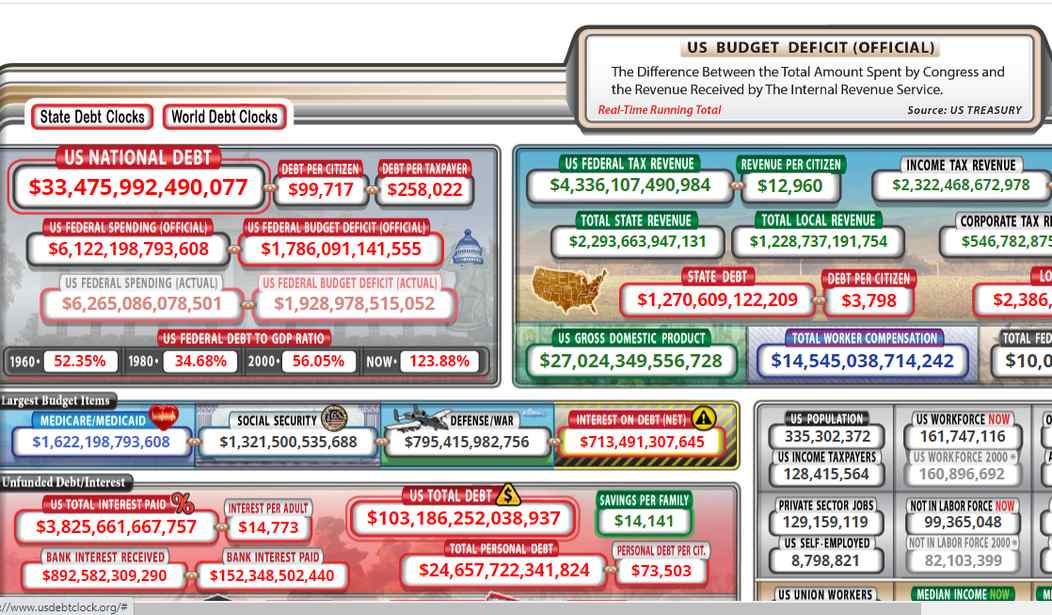

This was correctly brought up yesterday by the people who were supporting the motion to remove McCarthy as Speaker. I heard lots of talk about the $33 trillion in debt, which is such a huge, mind-numbingly large sum none of us can truly comprehend it.

Once again, let's go to the Congressional Budget Office for why this is not talked about:

In CBO's projections, the Old-Age and Survivors Insurance Trust Fund will be exhausted in the fiscal year 2032, and the Disability Insurance Trust Fund is exhausted in the calendar year 2052.

CATO breaks it down a little more

The Financial Report of the United States Government (also known as the Financial Report) raises significant concerns about the country’s long‐term financial health with increasing deficits and debt levels. Over the next 75 years, U.S. taxpayers face nearly $80 trillion in long‐term unfunded obligations. What’s more, 95 percent of this unfunded obligation is driven by only two federal government programs: Medicare and Social Security.

The overall takeaway here is this:

The Financial Report of the U.S. Government deserves more attention. The report’s findings are especially relevant in today’s political climate where politicians from both parties feel pressure to distance themselves from benefit cuts to Medicare and Social Security. The report makes it painfully obvious that Medicare and Social Security spending are the primary drivers of government debt. Adopting sensible reforms to old age entitlement programs is both necessary and urgent.

As I went on to explain further yesterday, I have a severe distrust of anybody who keeps using the $33 trillion that the United States currently owes in debt but offers vague solutions and does not bring up Social Security and Medicare.

As you can see in the brief quote from the overall takeaway provided by the Cato Institute, this entitlements part is urgent.

The report’s findings are especially relevant in today’s political climate where politicians from both parties feel pressure to distance themselves from benefit cuts to Medicare and Social Security. The report makes it painfully obvious that Medicare and Social Security spending are the primary drivers of government debt. Adopting sensible reforms to old age entitlement programs is both necessary and urgent.

So every time I hear an elected official claim that this is a priority of theirs and that we need to have the discussion about what to do with Social Security and Medicare, I'm not taking them seriously at all, and neither should you.

Now I know some will say that you have to have a change at the top (replacing McCarthy) to tackle this and some other things.

The time for that passed In January.

Now we are in a holding pattern, and each and every day, Congress delays and other opportunities pass, and the debt grows even larger. So if that were really a concern and also NOT mentioning Social Security and Medicare reform, I'm just not buying it.

One of the commentators yesterday on that post made an observation that is valid and also one that you hear a lot about this. Here is it in its partial form.

Before we start axing Social Security and Medicare, lets stop the corruption that cost those programs hundreds of millions and quit paying disability for everybody that breaks a fingernail and quit treating it like a child support system - I know of 4 women whose husbands/babydaddies died young and their kids got social security until they turned 18 and if the mom didn't work, so did she! Those right there are worth tens if not hundreds of millions. Then there is the corruption of thousands if not hundreds of thousands scamming the system.

There is no doubt in my mind that there is a $%^load of fraud in all government agencies and in Social Security and Medicare in general. However, some of the examples given above might be legal under rules passed by previous Congresses. If issues like this need to be revised, then that should be part of the overall discussion.

From the Committee for a Responsible Federal Budget report, here is a brief synopsis of what they found back in 2016.

• The Social Security Trustees estimate that reducing benefits to restore solvency would require an immediate 16.4 percent benefit cut – the equivalent of reducing benefits this year by more than $150 billion.

• According to the Social Security Administration’s Inspector General, in 2013 just over 1,500 deceased individuals in all age ranges were still receiving benefits. They account for only $15 million in improper benefit payments.

• A 2015 report found 6.5 million active Social Security numbers for people over the age of 112 – but only 13 of them were being used to receive benefits.

• According to the Social Security Administration, all improper payments, including payments to the deceased and the very old, are estimated at about $3 billion per year.

• Total Social Security benefits in 2016 will exceed $900 billion, so eliminating $3 billion per year of improper payments would reduce costs by at most 0.4 percent, extending the program’s solvency by about 3 months.

• Cutting improper payments for only the very old or the deceased would reduce program costs by between 0.00002 and 0.002 percent, extending the program’s solvency by between six minutes and 12 hours.

I'm confident that with the increased payouts and with the flood of illegal immigrants, particularly since Biden was inaugurated in January of 2021, fraud has increased exponentially. So I'm 100 percent for having people dive into this to find the fraud and even to redefine who qualifies for these programs.

The estimate of 0.4 percent, if correct, is a drop in the bucket to how massive this problem is.

Also, keep this in mind. Hundreds of millions of Americans who have been told all of their working life that they were guaranteed that social security was going to be there for them are still fully expecting it to be there for them.

Congress has changed the age and moved it from being lower to higher for when you can start receiving it, depending on the year that you were born.

Also, if you collect a federal pension, your Social Security benefits are reduced. There are many more examples of Band-Aid fixes to try to extend the life of the program.

My dad, who died at age 57 and paid into the system for 40 years, received a $255 death benefit. My mom, who lived for 28 years after his passing, never received any additional benefits linked to him other than the death benefit; all the money that he paid all those years evaporated Into the ether.

The system is beyond broken, and it is one of the reasons why people of my generation have never believed this program would be there for us even though we have paid into it. This is why I'm just highly skeptical of any politician who bemoans the $33 trillion in debt we have today and does not have the courage to talk about the $80 trillion on top of that for just Social Security, and Medicare is just posing for the cameras for social media glory.

If you truly want to see a revolution of the American people, let's have a discussion of the future of Social Security and Medicare, what it will cost, and what we will have to cut to save it.

Don't worry though.

We will never have that discussion until it's too late.

If I'm wrong, let me know by scrolling down to my bio below and checking me out on Twitter or Facebook for my radio show page. Leave a comment about who you might think has the stones to tackle this.