We’ve been sharing for some time that basic principle when it comes to economist Paul Krugman and WaPo writer Jennifer Rubin, you can pretty much bank on them always being wrong. So if they say something, you can probably be assured that the opposite is true.

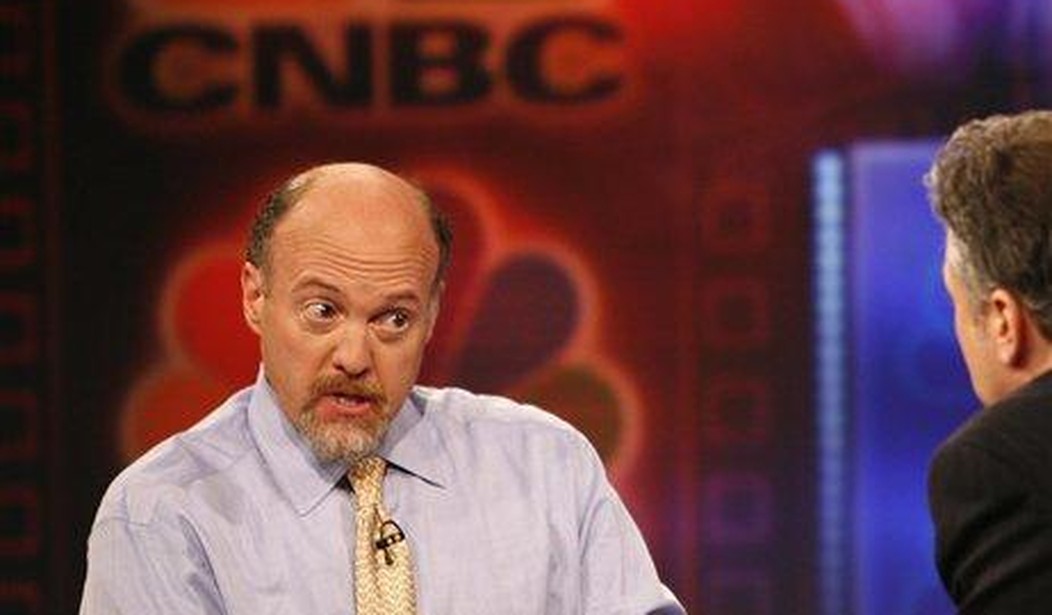

But CNBC’s Jim Cramer is in a special category by himself. Any time the host of “Mad Money” likes something, you know it’s time to run for the hills because something bad is about to happen to it. It’s the “inverse Cramer” effect. There’s even a Twitter account that was created just to track it.

— Dr. Nickarama (@nickaramaOG) April 14, 2023

I wrote back in March about the Jim Cramer principle when it applied to Signature Bank and Silicon Valley Bank.

He recommended Silicon Valley Bank, it went under. Then he recommended Signature, and it shut down.

As I explained in March, the “Inverse Cramer Tracker” was outperforming market trackers just by recommending that you do the opposite of whatever Jim Cramer says. Even Fox host Tucker Carlson has a little fun with him, “If that guy ever endorses anything you’re doing, move to the Canary Islands, change your name because disaster is coming!”

Goodbye CNBC @cnbc @jimcramer pic.twitter.com/SODOD0BLyb

— Stefanie Kammerman/The Stock Whisperer (@VolumePrintcess) March 12, 2023

He said in March we were on the “cusp of a soft, safe landing,” when it came to inflation. That, of course, was wrong. Inflation is still raging, without a soft landing in sight, unfortunately.

But I was a little concerned when I saw this tweet from Cramer on Thursday night.

Boeing's really incredible

— Jim Cramer (@jimcramer) April 13, 2023

I was afraid of what that might mean for safety. Many felt the same.

Do not fly on a Boeing plane tomorrow.

I repeat. Do not fly on a Boeing plane tomorrow. https://t.co/gSpnj4iOwT

— Greg Price (@greg_price11) April 13, 2023

Nice knowing ya @Boeing https://t.co/WZQN5VCtD6

— ALX 🇺🇸 (@alx) April 13, 2023

Many even said that if they had to fly, they were going to look for planes other than Boeing to fly on after Cramer’s statement.

But with that great ability, he has to be wrong, Cramer seemed to call it once again.

Boeing Co’s shares fell 6% in morning trading on Friday after the U.S. planemaker halted deliveries of some 737 MAXs due to a new supplier quality problem by Spirit AeroSystems.

The issue will likely affect a “significant” number of undelivered 737 MAX airplanes both in production and in storage, and could result in lowered 737 MAX deliveries in the near term, Boeing disclosed on Thursday.

They’re insisting that it’s not “an immediate safety of flight issue.” The company said the Max jets can continue flying “while inspections are underway” and the Federal Aviation Administration was going along with that.

But obviously, it’s now affecting Boeing’s shares.

Inverse Cramer declared him a “legend” once again.

LEGEND pic.twitter.com/6cjVUiWQZh

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 14, 2023

It’s now even worse since that tweet, down 7 percent. I don’t know how Cramer does it, it’s a special gift. But the inverse curse surely does seem to work.

Join the conversation as a VIP Member