(This is the sixth in a series of articles exploring Hunter Biden’s business dealings with Chinese entities. Additional reporting and research have been provided by RedState’s Scott Hounsell.)

When Chinese state-owned AVIC Auto and state-controlled Bohai Harvest RST partnered to purchase Michigan automotive supplier Henniges in September 2015, the transaction had to first be approved by the United States through the Committee on Foreign Investment in the United States (CFIUS) since it resulted in foreign “control” of a U.S. business that might pose a threat to national security.

The fact that Henniges’ anti-vibration technology is used on U.S. joint strike fighters like the F-35 and that the Chinese government would effectively obtain to that technology through its purchase should have been enough for CFIUS to deny approval. Government officials were also aware at the time that AVIC, through a subsidiary, was responsible for obtaining “terabytes” of F-35 technology from Lockheed and that the ill-gotten tech was being used in the development of China’s military fighter jets, which should have underscored the denial. And, a “research” subsidiary of AVIC was added to the U.S. export blacklist in 2014.

Then there’s the small issue of AVIC and its subsidiaries having been sanctioned by the US government on five separate occasions between 1993 and 2006 for violating the Arms Export Control Act and the Iran Nonproliferation Act:

- August 1993: Sanctioned for violating the Arms Export Control Act and the Export Administration Act in proliferating missile technology to Pakistan.

- May 2002: Sanctioned for transferring cruise missile components to Iran in violation of the 2000 Iran Nonproliferation Act.

- December 2004: Sanctioned for transferring equipment or technology in violation of the Iran Nonproliferation Act

- December 2005: Sanctioned for transferring equipment or technology in violation of the Iran Nonproliferation Act.

- December 2006: Sanctioned by the U.S. for transferring equipment or technology in violation of the expanded Iran, North Korea, and Syria Nonproliferation Act.

Those equipment and technology transfers “played a key role in enabling Iran to develop its missile capabilities.”

From the moment the news hit that BHR/AVIC was interested in purchasing Henniges in January 2015, industry experts predicted they’d have problems with CFIUS review/approval:

[T]he proposed transaction could invite scrutiny from Washington, according to one analyst.

Roy Kamphausen, senior adviser for political and security affairs at the National Bureau of Asian Research in Washington, said the deal may draw a watchful eye from the US.

“Almost certainly the purchase would raise the question as to whether a CFIUS review is in order,” Kamphausen told China Daily in an email. “Expect some commentary out of the Hill on the issue.”

Yet, CFIUS still approved the purchase. Why?

First, notice that the majority of the sanctions issued against AVIC occurred during the George W. Bush administration and involved China assisting Iran. As we know, Obama wasn’t fond of sanctioning Iran at all; he was more fond of sending them a planeload full of cash.

Second, according to a 2014 Washington Free Beacon article, there was a “systematic loosening of technology controls on transfers to China,” under the Obama administration. From 2009 through 2015 the administration was more concerned about getting foreign dollars into the country to stimulate the economy than it was about national security, and state-backed Chinese companies had a lot of cash and a long-range plan. This chart showing the timeline of AVIC acquisitions in the aviation industry alone shows how busy the ChiComs were during the Obama years:

Screenshot, “The Wire”

In addition to these approved AVIC acquisitions, the Obama administration routinely approved joint ventures between Chinese and American companies that could involve the transfer of technology with military applications – despite Pentagon opposition. As the 2014 Free Beacon article stated:

Pentagon technology security officials in 2011 opposed a joint venture between General Electric and AVIC over concerns that U.S. fighter jet technology would be diverted to AVIC’s military aircraft programs. The Obama administration ignored the concerns and instead has since promoted the systematic loosening of technology controls on transfers to China.

Some analysts sounded warnings at the time these transactions were being proposed and approved by the Obama administration, warning that what perhaps looked like a benign transaction could be anything but. For example, when AVIC bought out small aircraft manufacturer Cirrus, then-Rep. Chip Cravaack (R-MN) forcefully voiced his concerns to then-Treasury Sec. Timothy Geithner, whose department would head CFIUS review and approval. In a March 29, 2011 statement he wrote:

“As for my security concerns, given the fact that Cirrus is being sold to a Chinese state-owned defense contractor, I think it is important that CFIUS experts carefully verify that Cirrus’s manufacturing techniques and carbon fiber materials would not aid in China’s development or production of unmanned aerial vehicles. Most importantly, the U.S.-China Economic and Security Review Commission has confirmed to me that the FJ33 and FJ44 engines and accompanying FADEC’s are in fact export controlled. This acquisition deserves more than a cursory stamp of approval, and that is what I requested with my letter to Secretary Geithner.

The transaction was approved anyway, and it’s likely that Cirrus’s manufacturing techniques and carbon fiber materials did aid in China’s development and production of unmanned aerial vehicles.

While people like Chip Cravaack could see the big picture, some analysts interviewed for a recent piece in The Wire China said that it was only later that patterns in China’s acquisitions were clear. Brendan Mulvaney, director of the China Aerospace Studies Institute at the Air Force’s Air University, said:

“They’re acquiring A, B, and C from these different companies. Acquisition A isn’t really a big threat, and B isn’t a threat, and C isn’t a threat. But when you link those things together, we realized that it allowed them to build a kind of rocket or fix their jet engine problem. … When you put them all together, then you’re like, holy cow, now I totally see what they’re doing.”

As Alanna Krolikowski, professor at Missouri University of Science and Technology who studies innovation in China and the United States, told The Wire:

“These acquisitions don’t simply plop a better fighter jet in the lap of China’s military,” she says. But certain acquisitions “can contribute to that holistic improvement and upgrading of the industrial base.”

That’s precisely the point of the Henniges transaction.

BHR didn’t intend to co-own Henniges with AVIC forever, though, which makes the acquisition even more troubling. A 2016 BHR document obtained by Breitbart News, which looks to be a corporate overview or prospectus, explains, among other things, “BHR’s Cross-Border Investment Targets and Strategy.”

The fund first identifies a target company, then identifies a “Strategic Partner” (a state-owned entity) in the same sector, then “acquire[s] the controlling stake in each Target Company, either jointly or on behalf of [their] Strategic Partner.” After maximizing the Target Company’s growth potential, they “exit from our investments through listings or block sale to our Strategic Partner or other financial investors,” as shown in this slide.

The Henniges transaction, referred to in this document as “Project Hanson,” is used as a case study for how BHR transactions should work and states the “BHR team’s” role in that transaction (emphasis added):

BHR team actively participated in and provided invaluable insight at each stage of the acquisition from valuation, due diligence (legal, financial, environmental, labor, IP, tax, antitrust), bidding, competitive bidding strategizing, SPA negotiation, regulatory approvals (CFIUS, anti-trust) and finally to the successful closing of the acquisition.

Who is the BHR team? According to the BHR document, Rosemont Seneca Thornton wasn’t the American portion of the team as has been previously reported; rather, the American portion of the team was comprised of Rosemont Seneca Partners and Thornton Group, LLC.

That is significant because Chris Heinz, through a spokesman, denies being part of Rosemont Seneca Thornton and denies knowledge of their activities, claiming that Devon Archer set the company up without his knowledge. Rosemont Seneca Partners, though, was formed in 2009 by Heinz, Archer, and Hunter Biden. Thornton Group, LLC is the company owned by James Bulger and Michael Lin.

Whether or not Heinz was a part of BHR’s activities, there was a Rosemont entity involved. Since Devon Archer had been Heinz’s business partner for years, then-Secretary of State John Kerry would have recognized both the Rosemont name and Archer as the BHR team “actively participated in and provided valuable insight” in “regulatory approvals.” And, of course, then-Vice President Joe Biden’s son would have been involved.

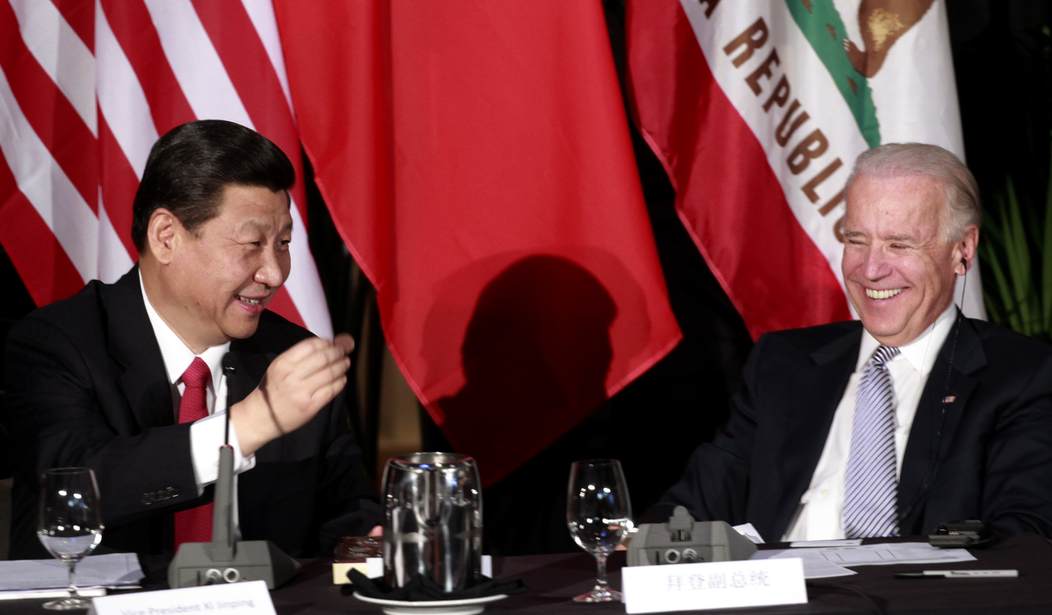

By 2015, when Henniges was going through the CFIUS review process, tensions were growing between Beijing and Washington over the issue of CFIUS reviews. Or, perhaps a more accurate description is that Beijing wanted fewer restrictions and oversight, and Obama and Biden were doing all they could to make President Xi Jinping happy. Biden and Xi had a relationship going back years, to when Xi was Vice President, and Biden has boasted that the two have spent more than 25 hours in private conversation over the years, with only one translator present.

Coincidentally, Xi had a state visit scheduled around the same time CFIUS approval for the BHR/AVIC purchase of Henniges was finally obtained. New language “limiting the scope of investment screening for security interests” was reached by the two countries during that visit, as the Rhodium Group reports (emphasis added):

The most important progress from President’s Xi state visit with regard to investment is joint language on limiting the scope of investment screening for security interests. The national security screening criteria that China most recently included in its draft foreign investment law are very broad and greatly expanded previous definitions. At the White House the two leaders agreed to “limit national security reviews for foreign investment solely to issues that constitute national security concerns, and not to generalize the scope of such reviews to include other broader public interest or economic issues.”

They also agreed that final passage of a new law from the Chinese side would not trigger retrospective review of every investment already in operation. They endorsed the important principle that mitigation solutions, rather than wholesale prohibitions, should be offered to investors when some legitimate national security issue is present. It remains to be seen how these commitments are implemented in light of existing Chinese laws and regulations, but it is a step forward that China agreed to these principles.

So, limiting national security reviews and finding “mitigation solutions,” like prohibiting the military use of technologies purchased by Chinese entities? Yeah, the CCP will totally adhere to such agreements. And, the kicker – final passage of a new law that was pending in China would not trigger retrospective review of every investment already in operation. These talks were held just a week after CFIUS approval of the Henniges transaction, conveniently.

Kerry also hosted a State Lunch for Xi, with Madeline Albright and Henry Kissinger in attendance, at which he and Joe Biden made glowing remarks about the Chairman.

Vice President Joe Biden speaking at State Lunch with Secretary of State John Kerry & Chinese President #XiJinping. pic.twitter.com/XTw55jK9sJ

— Ted Lieu (@tedlieu) September 25, 2015

CFIUS rulings made during the Obama years, especially the approval of AVIC’s purchase of Henniges, have allowed China to improve their military aircraft industry “in a relatively short period of time:

“Ultimately, a good deal of defense-related technology made its way into China, which directly or indirectly helped improve China’s military aircraft industry,” says Larry Wortzel, a commissioner on the U.S.-China Economic and Security Review Commission. Wortzel thinks some of the CFIUS rulings in the past decade are to blame. “In a relatively short period of time the People’s Liberation Army has been able to equip its Air Force and Naval Air Force with modern fighters, stealth technology, top of the line radar systems, new helicopters, and up-to-date unmanned aerial vehicles.”

Undoubtedly many of the acquisitions gained CFIUS approval because Obama appointeees were short-sighted and either unable or unwilling to see the pattern of Beijing strategically purchasing companies that had specific technologies they were lacking. In the case of AVIC’s acquisition of Henniges, the fact that so many red flags were raised about AVIC in the years before the approval combined with the extremely sensitive nature of Henniges’ technology should have made denial a no-brainer. John Kerry, Joe Biden, and Barack Obama should be called on the carpet and asked, “Why did you allow this to happen?”

Join the conversation as a VIP Member