The opinions expressed by contributors are their own and do not necessarily represent the views of RedState.com.

It hasn’t been a good day for the banking industry. As our Senior Editor Joe Cunningham reported, Silicon Valley Bank was taken over by bank regulators. The 16th largest bank in the nation, and once a darling of tech industry, its downfall could be directly connected to the woes, layoffs, and setbacks in that very industry.

Silicon Valley Bank (SVB), a financial institution that focused primarily on investing in tech start-ups, has been taken over and shut down by federal regulators in one of biggest financial failures in history, and the biggest since the Global Financial Crisis over a decade ago.

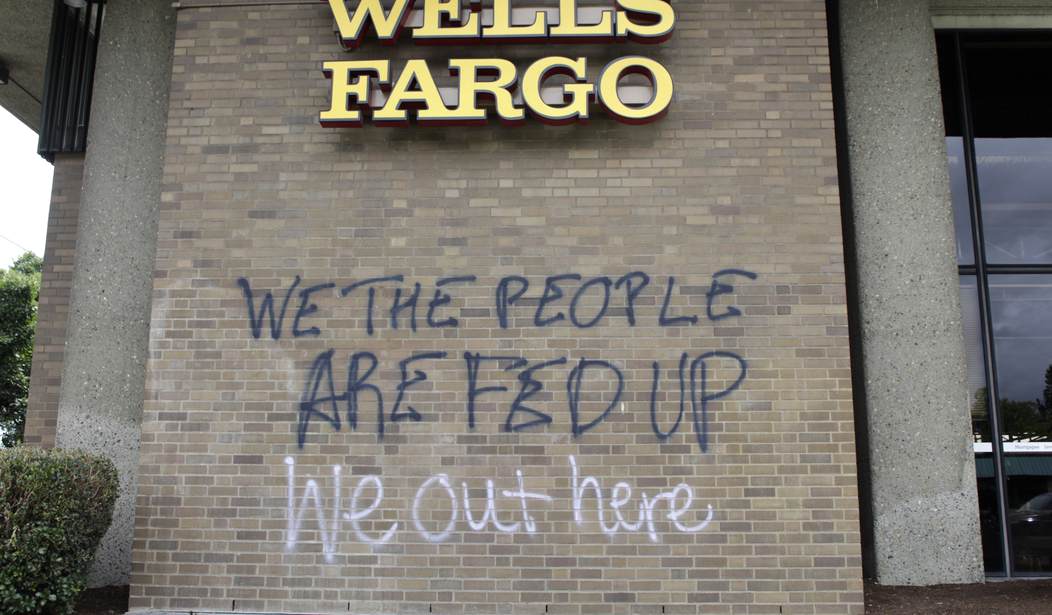

The banking giant Wells Fargo Bank (WFB), which was one of the main drivers of that 2008 global financial crisis, has also been showing cracks that portend more problems. The Street gave the lowdown on WFB’s prior missteps and latest woes.

Between the $3.7 billion loan mismanagement fine it was hit with in December 2022 and lawmakers like Elizabeth Warren (D-Mass.) calling for its dissolution, Wells Fargo is not looking so hot lately.

That’s not even including barely believable stories about its top brass — such as the story of the Wells Fargo VP that urinated on a female passenger during a flight in January.

But now Wells Fargo is trending on Twitter yet again — this time due to numerous customer reports of missing deposits and paychecks.

THESE ARE THE COMMENTS UNDER WELLS FARGO'S LAST TWEET

WHAT IS HAPPENING @WELLSFARGO ?? pic.twitter.com/xXEgTgP5iL

— GURGAVIN (@gurgavin) March 10, 2023

As George Takei delights in saying, “Oh. My.”

From NBC News:

Some Wells Fargo customers woke up Friday morning to find deposits missing from their checking accounts.

In a statement to NBC, the bank acknowledged some direct deposit transactions were not showing up in accounts and that they were working on a resolution. Wells Fargo said the accounts were safe and secure.

That is of little comfort. For most Americans, security means our money is there when we need it, and in this time of inflation and slim margins, that’s every day. I know of very few people that have money just sitting around in the bank—not at less than 2 percent interest, anyway.

The fact that there is so much buzz about Wells Fargo having payday direct deposit problems this morning exposes the larger problem with how many people live paycheck-to-paycheck in America. https://t.co/2ssk5OR5FC

— BitterAfterDark (@BitterAfterDark) March 10, 2023

It’s the beginning of March, and we just scraped out our checking account to pay rent, as many others had to do for their mortgages and rents. So, to find that any amount previously deposited, or scheduled to be deposited is now missing, would have caused us to go ballistic. As the tweet above indicates, Wells Fargo’s social media accounts, not to mention their customer service phone lines, are on meltdown.

Upset customers began reaching out to the bank on social media overnight Thursday to report recent deposits that had been listed in their account were now missing, or deposits that were expected Friday were not there, affecting what showed in the available balance.

In a statement to customers early Friday morning, the bank said the missing deposits were due to an unspecified technical issue.

“If you see incorrect balances or missing transactions, this may be due to a technical issue and we apologize. Your accounts continue to be secure and we’re working quickly on a resolution,” the bank said in a statement posted to customers on their website.

Again, cold comfort. On top of mortgages and rents, there are automatic payments being pulled and then rejected from these accounts because of non-sufficient funds. That can only add to an already scary and stressful ordeal. (Note: Language warning)

ATP I’m gonna lose my shit .

It’s been at least 6 hours since Wells Fargo’s “system glitch” & still no resolution .

Surely it’s illegal to withhold a direct deposit from THOUSANDS of people .

On top of that , I’m getting notifications that I am being charged over draft fees ?!— Rae 🥀 (@Desirae_4) March 10, 2023

I'm overdrafted about $1,000 bucks because wells fargo thought it would be cool to take my two checks that were deposited WEDNESDAY out of my account.

— luke (@lucasmcgrand) March 10, 2023

It was not immediately clear how widespread the issue is or how many customers it affected.

Wells Fargo has not yet released any further details about the problem or when it will be resolved.

Unacceptable. When the situation is reversed and we are the ones on the hook to the bank, all measures to bleed us dry are employed until they receive their funds. When the shoe is on the other foot? We’ll get back to you.

My direct deposit @WellsFargo has completely disappeared from my accounts leaving me in the negative. Does this mean #wellsfargo will pay ME a fee for not having access to my money? 🤔

— Jabari Thomas WTSP (@Jabari_Live) March 10, 2023

The customers who haven’t already done so, are threatening to close their accounts. Better late than never, I guess.

Wells Fargo took my direct deposit AND reached up in my savings 😂 best believe I’m switching banks come Monday

— G$ (@doihavetobeG) March 10, 2023

If you're still banking with Wells Fargo, after all the nonsense they've pulled in the last 20 years, you're an idiot.

Get thee to a local bank or credit union.

— Denise the Mennis (@InsightGrammar) March 10, 2023

At the rate things continue to go with banking and the stock market, I’d say: go to the mattresses… literally.

First SVB and now Wells Fargo, the way these banks are acting I'm about to have to go back to keeping my money under mattresses and in shoe boxes.

— Everette Taylor (@Everette) March 10, 2023

Join the conversation as a VIP Member