Internal Revenue Service (IRS) Whistleblower Gary Shapley and another agent who, to date, has remained anonymous are set to testify before the House Oversight Committee Wednesday afternoon beginning at 1:00 pm Eastern. While we’ve covered much of Shapley’s testimony, along with his recent interviews and statements issued by his attorneys, there has not been as much reported regarding “Whistleblower X,” his fellow Special Agent, who testified before the House Ways and Means Committee on June 1st.

WATCH the House Oversight Committee hearing live here.

Ahead of Wednesday’s hearing, both Shapley and Whistleblower X, whose identity will be revealed at the hearing, have released written opening statements. From those, we learn that Whistleblower X is a 13-year Special Agent with the IRS Criminal Investigation Division. He also happens to be a gay Democrat who is married to a man.

Below are some key excerpts from Whistleblower X’s prepared remarks:

Whistleblowers play a vital role in our society shining a light on the darkest corners, risking personal reprisal for the greater good. Let me emphasize that my testimony is not an attack on any specific individual or political party. My aim is to address systemic problems that have allowed misconduct to flourish. It is a not a call for blame, but a call for accountability and reform. At the end of the day, these are ultimately the two reasons for me being a Whistleblower. I believe that we need to hold those accountable for their unethical and inappropriate behavior, so that we can learn from our mistakes and create policy and reform so that this doesn’t happen again in the future.

Transparency is the foundation of our democracy. Without it, people lose their trust in the institutions, and the bonds that tie the fabric of our nation start to fray. The American people deserve to know the truth, no matter how uncomfortable or inconvenient it may be for either political party, or those in power.

I had recently heard an elected official say that I must be more credible, because I am a gay democrat married to a man. I’m no more credible than this man sitting next to me due to my sexual orientation or my political beliefs. I was raised, and have always strived to do what is right. I have heard from some, that I am a traitor to the democratic party, and that I am causing more division in our society. I implore you, that if you were put in my position with the facts as I have stated them, that you would be doing the exact same thing – regardless of your political party affiliation. I hope that I am an example to other LGBTQ people out there, who are questioning doing the right thing at a potential cost to themselves and others. We should ALWAYS do the right thing, no matter how painful the process might be. I kind of equate this to coming out, it was honestly one of the hardest things I ever had to do. I contemplated scenarios that would have been highly regrettable. But I did what was right and I am sitting in front of you here today.

….

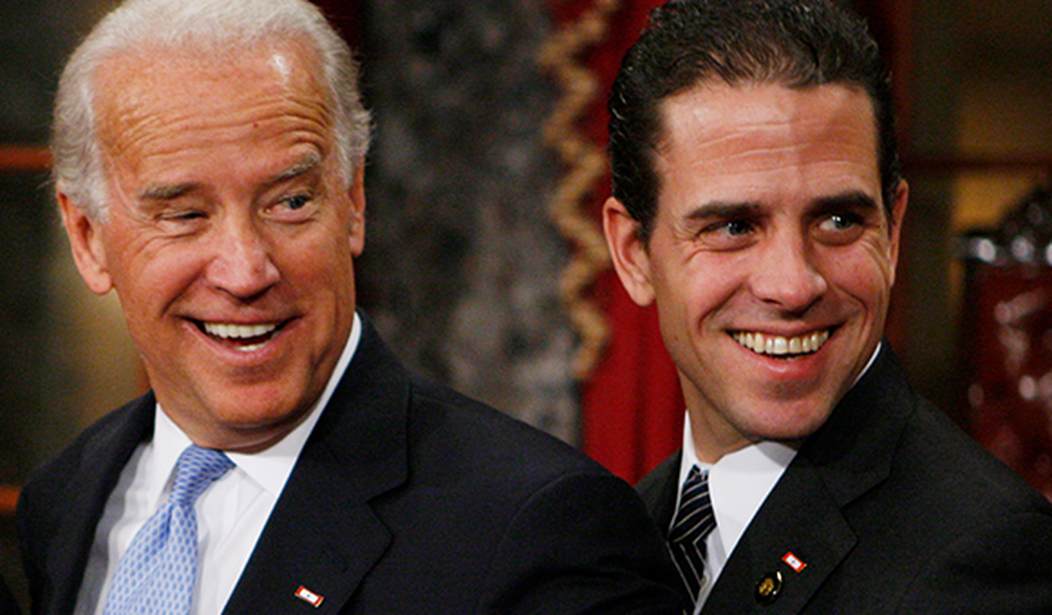

In Early August of 2022, federal prosecutors from the Department of Justice Tax Division drafted a 99-page memorandum. This memorandum recommended approving felony and misdemeanor charges for the 2017, 2018 and 2019 tax years. If the Delaware U.S. Attorney David Weiss followed DOJ policy as he stated in his most recent letter, Hunter Biden should have been charged with a tax felony, and not only the tax misdemeanor charge. We need to treat each taxpayer the same under the law.

….

In early 2020, Hunter Biden’s unfiled and delinquent tax returns were being prepared, which included his 2018 tax return. During the 2020 time period, by Hunter Biden’s own account he was sober, newly married, and writing his memoir. Hunter Biden’s accountants requested that he sign a representation letter stating that all deductions were for business purposes and were being reported appropriately. Statements Hunter Biden made in his book completely contradicted what was being deducted as business deductions on his 2018 tax return. While writing his memoir. Hunter Biden stated, “I holed up inside the Château for the first six weeks and learned how to cook crack.” For this time period, Hunter Biden claimed business deductions for payments made to the Château Marmont, a hotel room for his supposed drug dealer, sex club memberships (falsely referenced on the wire as a golf-membership), hotels he was blacklisted from, and a Columbia University tuition payment for his daughter. All of these items were used to support the willfulness element for felony tax evasion and false return as they would be in any case involving any other taxpayer. These false deductions claimed by Hunter Biden caused a false return to be prepared that underreported his total income by approximately $267,000 causing a loss to U.S. Treasury of $106,000. This loss is referred to as a “tax deficiency”.

With respect to the 2014 tax year, Hunter Biden did not report any of the money he earned from Burisma for the 2014 tax year, which would have been a tax loss to the U.S. Treasury of $124,845. According to my previous testimony, Hunter Biden did not report this income to the IRS or pay tax on this source of income.

The full statement is 15 pages long and goes into greater detail, but the above excerpts give some of the flavor of Whistleblower X’s anticipated testimony. The hearing is guaranteed to be worth the watch.

Join the conversation as a VIP Member