It’s not surprising that California Gov. Gavin Newsom and the state’s Democrat lawmakers want to create a new government program to provide residents relief from exorbitant gas prices in the state (in the form of $400 rebate debit cards) instead of taking at least one extremely easy and immediate action: pausing gas tax collection for a few months or longer. Of course, simply pausing tax collection doesn’t create more bureaucracy to keep public union pencil-pushers busy, doesn’t give Newsom an opportunity to send people money with a note signed, “Love, Gavin,” close to election time, and doesn’t allow him to point out special interest groups he’s including, i.e., illegal immigrants.

In addition to using a crisis to create a vote-buying, virtue-signaling scheme, there are other reasons Newsom won’t just do the simple thing. But first, here are the components of Newsom’s plan:

- Send a $400 debit card to all Californians who have a vehicle (including motorcycles and electric vehicles) registered in their name

- People with more than one vehicle registered in their name can only get a max of $800 – but there’s no household cap.

- $750 million to transit and rail agencies “to offer free or substantially reduced fare” and encourage the use of public transit

- Pause sales tax on diesel (but not gas) for one year

- Pause yearly inflation increases on gas and diesel excise taxes (the next one is scheduled to hit in July)

Since Democrat leaders in the legislature have their own plan and fundamentally disagree with a universal plan with no income qualifications, it’s doubtful that Newsom’s plan will pass as-is. Regardless, one of the biggest issues with either plan is that it won’t provide any relief for months, if ever (if the problems Californians have had with receiving pandemic unemployment benefits are any indication). Polls show that Californians are concerned about being able to pay for housing in light of the skyrocketing gas prices and want relief immediately. Why are Democrats so resistant?

Simply put, if they pause the gas tax, they won’t have control over who receives what, and when; they will have a much smaller pot of money to play Oprah with; everyday Californians will see that lower taxes lead to economic growth; and, it will be crystal clear that the exorbitant gas taxes they’ve been paying for years haven’t gone to fixing roads and bridges.

As Asm. Kevin Kiley (R-Rocklin) says:

Corrupt politicians will always prefer "rebates" to actual tax relief because that keeps them in charge of who gets the money and when it's delivered.

— Kevin Kiley (@KevinKileyCA) March 24, 2022

One big argument California Democrats make against pausing the gas tax (meaning the state excise tax) is that infrastructure projects funded by the excise tax will be harmed or at risk of cancellation. Given the state’s budget surplus (the one Newsom is constantly bragging about), that doesn’t have to be the case – unless Dems want it to be the case. And they want it to be the case. They want it to be the case because they already have plans for the budget surplus – and that plan includes lots and lots of targeted handouts. They also want it to be the case because it would be a great campaign theme for November. So that argument is bogus and they know it, but they’ll continue making it – until they decide to give people “crumbs” disguised as $400 debit cards.

But it’s not just the current surplus they’re concerned about. If the gas tax is paused, next year’s funding for current/planned infrastructure projects will be impacted and they’ll need to use some of the surplus for that.

And, if the gas tax is paused, it will impact another source of revenue in a big way.

Currently, Californians pay 51.1 cents in state excise taxes on each gallon of gas, in addition to 18.4 cents in federal excise tax. According to the Legislative Analyst’s Office, other state policies and regulations relating to underground storage tanks, cap and trade, and low carbon fuel standards add 43 cents a gallon to gasoline prices, meaning that Californians are paying $1.12 per gallon in excise taxes and fees.

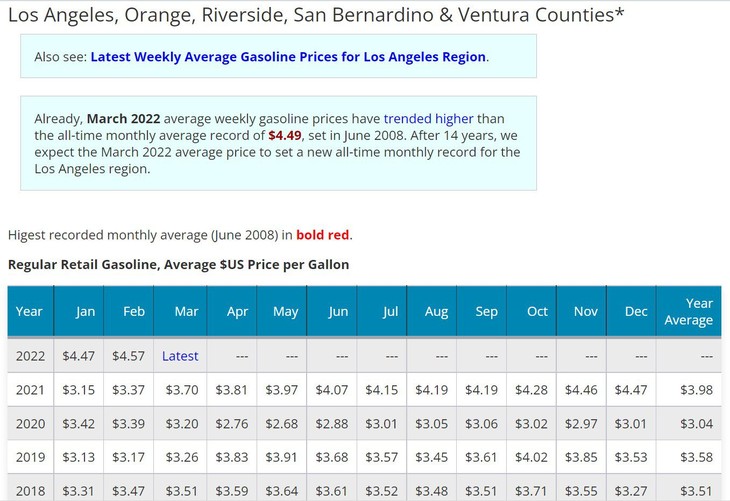

Then we have state and local sales tax, which ranges from 2.25 to 5.75 percent per gallon. (California is one of only 11 states that impose some form of sales tax on gasoline.) Newsom proposes pausing these taxes for one year, but only on diesel. Here’s the clue to another major reason Newsom won’t pause the collection of state excise taxes: since sales tax is calculated on the actual sale price, the state’s coffers are filling up with gas sales tax revenue. As the chart below from LA Almanac shows, current gas prices are almost double what they were at the beginning of the pandemic.

Sales tax revenues aren’t subject to the same restrictions as excise tax revenue, making them even more valuable to corruptocrats who want to use working Californians as an ATM funding their addiction to buying votes and collecting kickbacks.

There have been two votes so far in the California Assembly to suspend the gas tax, and Democrats are on record either opposing it or, for those in purple districts, abstaining. But the public outcry is getting louder by the day. Will Gavin Newsom and the Democrats stick to their anti-worker policy, betting that voters will forgive them once those sweet debit cards start hitting mailboxes, or will the pressure be too much?

Join the conversation as a VIP Member