As I exclusively reported in July and August, California Governor Gavin Newsom owns not one, but two estates in California and has received sweetheart cashout refi mortgages on both – and has been chronically delinquent in paying his property taxes.

Though he paid his property taxes for 2019 in early August 2020 after RedState (exclusively, again, despite what you might have seen at OANN and other conservative sites) pointed out that he was delinquent and accruing large penalties, he hasn’t yet paid 2020 taxes that were due November 1. Here is the property tax bill for his Fair Oaks estate (in a suburb of Sacramento):

Yes, that’s quite the property tax bill, but considering he got the bulk of the value of the home back as a cashout refi in 2020, he should have it somewhere.

As a reminder, here’s an aerial view of that estate.

And a view of the home:

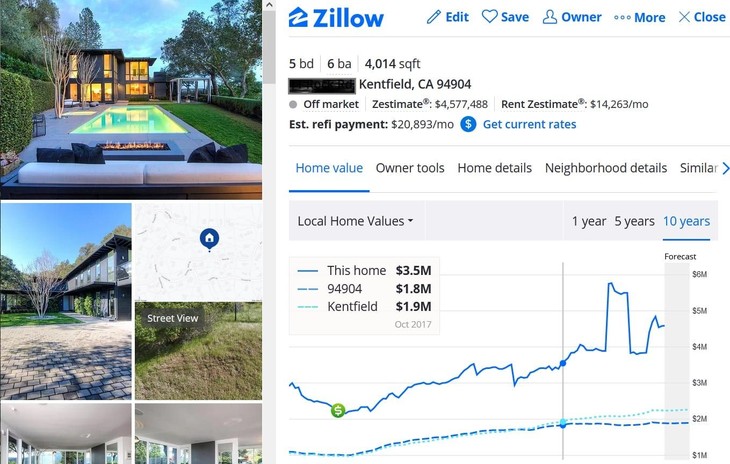

Here’s the property tax bill for his Marin County estate, just outside San Francisco:

That one’s worth even more, close to $6 million.

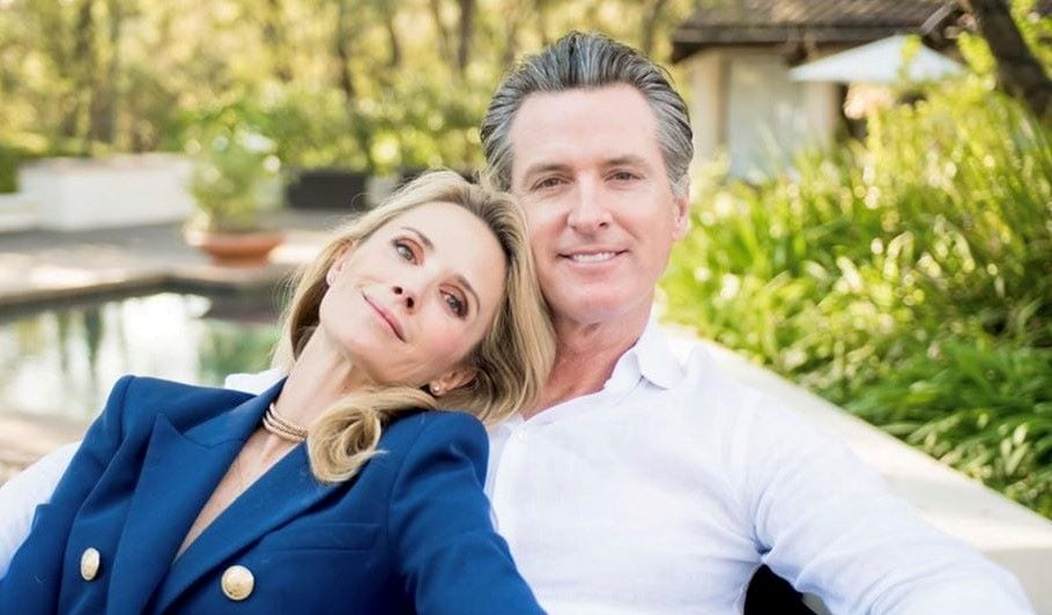

Here are some photos of that home.

Why don’t you have the cash on hand, given that you got an 80+ percent cashout refi on that house, Governor? How do you expect average Californians, who haven’t had a regular paycheck all damn year, to pay their property taxes when you don’t?

Having a hard time meeting the moment, Governor?

And more importantly, at which mansion will you be spending a socially-distanced Thanksgiving? Will you be adhering by the rules you set for that, even though you’re clearly not interested in adhering to any other rule you set for the rest of us peons?

(NOTE: Many Californians don’t pay their property taxes until just before penalties accrue, which is 12/10/20 in this instance, but that doesn’t change the fact that they’re due 11/1/20. As Governor, and having cashed out more than $5 million on these properties in the last few years, he should pay on time. And no, his mortgage company is not holding these funds in escrow. RedState has full mortgage documents on both properties but we’re not publishing them for privacy reasons.)

Join the conversation as a VIP Member