According to the Trustees of the Social Security Trust Funds, the program as a whole has made $22.6 trillion in promises to current voters, for which it does not expect to generate the cash necessary to keep. If the forecast is correct, people who are 80 years old expect to outlive the system’s ability to pay scheduled benefits.

This problem should be at the top of every lawmaker’s list of priorities, yet appears to be on the list of none. Politicians are ready to protect Social Security against everything but Congress itself. This situation calls for the media to step in, and hold politicians accountable for the ridiculous claims that they make, and the promises made that continually go unfilled.

The media needs to build a framework of fact on which lawmakers can build consensus, rather than publishing speculative rumors about the program’s short-comings.

There is a rather lengthy list of emotionally charged mythology that shrouds Social Security in a veil of lunacy. At the top of the list of the absurd is the notion that Congress has been using Social Security surpluses for decades to fund other spending priorities. This is effectively the economic equivalent of the Loch Ness Monster, and yet the legend has become an integral part of the discussion of reform.

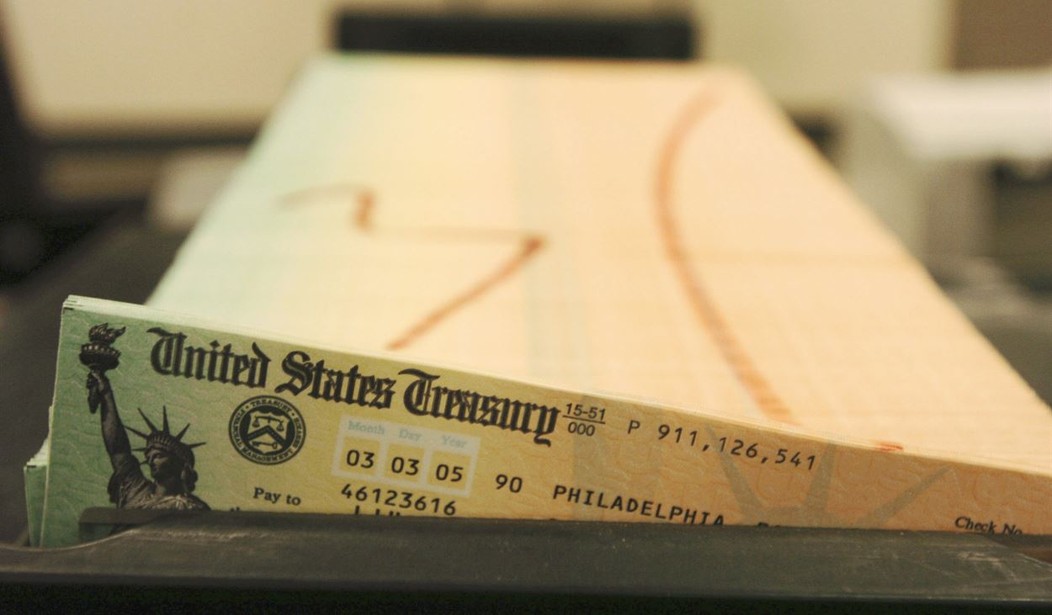

The math is pretty straightforward and conclusive. Every penny ever collected in payroll taxes for Social Security has been paid to eligible beneficiaries. From Social Security’s inception to the end of 2023, the Old-Age Survivors program has collected roughly $20.7 trillion in payroll tax revenue. Over that period of time, the program has distributed nearly $21.4 trillion in benefits to eligible retirees, when you include the cost of writing the check.

That doesn’t leave a lot of room to spend the money on anything else. In fact, Social Security hasn’t generated a penny of excess cash required to spend your hard-earned dollars on other programs since 2010.

At the end of 2023, the program held roughly $2.7 trillion in reserves. While pundits call these securities “IOUs,” trained investment professionals call the same securities “Cash Equivalents.” Yet, this annoying game of “potato, potahto” has managed to carve out a niche in every debate about Social Security in this century.

What we call the securities does not change the problem.

At this point, the Trustees who are responsible for the management of the trust funds do not have a loan loss set-aside for the possibility of default on these securities. Moreover, no one with any credibility suggests that these loans will not be repaid with interest. So, if these loans are not repaid with interest, the problems of Social Security would spiral higher.

Setting name-calling aside, the current reserve is a mix of interest, interest on interest, and general fund subsidies. That’s right, Congress is not spending Social Security reserves on other priorities. The government has drawn nearly $1 trillion in revenue away from other priorities over the past 25 years to prop up the program’s image of stability.

Politicians want to shuffle feet with the language of status quo. So, they tell you: “I am not at fault. It was those other congressmen.” It was those rascals who will remain nameless that snuck in the middle of the night that took your hard-earned money. Instead of ridiculing the ruse, the media repeat the statement, providing politicians the impression of trust.

President Barack Obama is no longer in office, so he is fair game. In 2012, he answered a question about Social Security with the response, “Social Security is structurally sound. It will have to be tweaked the way it was by Ronald Reagan and Democratic Speaker Tip O’Neill.” This is an absurd claim, but voters bought into it because the media didn’t cover the story.

Forget demographics. Forget the story of raids on the Trust Fund. The problem of Social Security is blind faith. Voters ask too few questions, and accept answers no matter how implausible. This blind faith has been leveraged year over year for decades, and now the hole is $22.6 trillion deep.

Brenton Smith ([email protected]) is a policy advisor with The Heartland Institute.

Join the conversation as a VIP Member