But you and I both know that with only 2% of the world’s oil reserves, we can’t just drill our way to lower gas prices – not when consume 20 percent of the world’s oil.

— Barack Obama, March 10, 2012

Oh, really?

That was the refrain during the election season of 2012, with average gasoline prices crowding $4.00 per gallon and no relief in sight. Democrats painted Republicans as wackos for thinking $2.50/gallon gasoline possible. But eighteen months have passed since the President’s misleading pronouncement: the U.S. is now poised to surpass Russia and Saudi Arabia as the the world’s #1 producer of oil and natural gas. The boom in domestic production continues, with oil production at levels not seen in a generation. Demand is soft, oil inventories are high and there is refinery capacity to spare.

And guess what? Gasoline prices are dropping. Color me unsurprised.

(http://www.eia.gov/oog/info/twip/twip_gasoline.html)

The scale of that graph masks the fact that the average price of gasoline is down 33¢ per gallon over the last 12 months and 70¢ per gallon since the spring of 2012. The reader should also bear in mind that the retail price of gasoline has embedded state and federal taxes which vary from 35¢ to 70¢ per gallon, depending on jurisdiction.

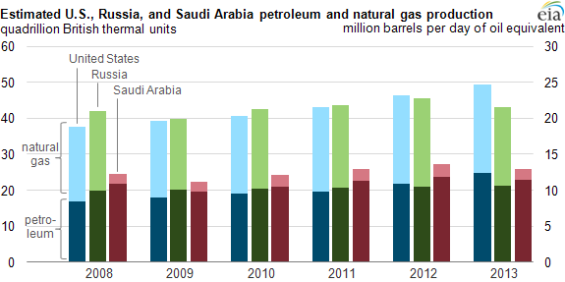

U.S. expected to be largest producer of petroleum and natural gas hydrocarbons in 2013

The U.S. Energy Information Administration estimates that the United States will be the world’s top producer of petroleum and natural gas hydrocarbons in 2013, surpassing Russia and Saudi Arabia. …

Since 2008, U.S. petroleum production has increased 7 quadrillion Btu, with dramatic growth in Texas and North Dakota. Natural gas production has increased by 3 quadrillion Btu over the same period, with much of this growth coming from the eastern United States.

From Bloomberg:

WTI crude falls near four-month low as U.S. inventories increase

West Texas Intermediate crude [WTI, a price benchmark] fell to the lowest level in almost four months as supplies rose more than expected in the U.S., the biggest oil-consuming country. Prices dropped as much as 2.2%. … [Oil] Stockpiles at Cushing, Oklahoma, increased for a second week and domestic production jumped to the most in 24 years. …

“Fundamentally, it’s a weak market for WTI,” said Tariq Zahir, a New York-based commodity fund manager at Tyche Capital Advisors. “Everything points to lower prices.” …

U.S. crude production grew 6.3% last week to 7.9 million barrels a day, the most since March 1989. …

Refineries operated at 85.9% of capacity, the lowest level in almost six months. Total petroleum demand dropped 3.8% to 18.3 million barrels a day. The four-week average was 18.7 million, a 17-week low. …

The oil patch is one of the bright spots of our economy. Since 2009, the industry has been a true engine for jobs. But declining prices, especially for natural gas, have served as an organic non-governmental stimulus that has benefited the broad economy:

Newly found sources of domestic oil and natural gas are having an even bigger impact on the economy than first projected, adding more than $1,200 last year to the discretionary income of the average U.S. family, a new study says. …

More domestic production is also slashing crude oil imports, which fell 19% in the first half of this year, according to the Census Bureau. That shaved $31.6 billion off the nation’s trade deficit. [Source.]

Speaking of the trade deficit, refined petroleum products including gasoline and jet fuel are now the nation’s #1 export.

The potential benefit of domestic oil and gas development is self-evident. What a shame that our political leadership fights it at every turn.

Join the conversation as a VIP Member