Central Gulf of Mexico lease sale attracts $1.2 billion

North Dakota oil production reaches new high in 2012

Chevron Corporation overtakes Royal Dutch Shell plc

Anadarko Deepwater Well Encounters More Than 1,000 Net Feet of Oil Pay

Major workforce shortage pounding energy industry

Excerpts and commentary below the fold…

Offshore Lease Sale

A nearly 39 million-acre oil and gas lease sale for the central Gulf of Mexico drew $1.2 billion in high bids by offshore energy producers. The Bureau of Ocean Energy Management [BOEM] said 52 companies submitted 407 bids on 320 tracts, three to 230 miles off the coasts of Louisiana, Alabama and Mississippi. The tracts, covering more than 1.7 million acres, are in water depths of nine to more than 11,115 ft.

The highest bid in the sale was $81.8 million for Walker Ridge Block 271 by Statoil and Samson. Another highly contested area was Walker Ridge Block 187, where Venari Offshore’s $45.5 million bid edged out a $43.5 million bid from Anadarko. Statoil was the winner on 15 blocks and now holds 340 leases in the Gulf of Mexico. (World Oil)

In keeping with the trend of recent sales, deepwater dominated. Shallow water tracts (< 500 feet water depth) accounted for something like a quarter of the total blocks receiving bids. Only two shallow water bids exceeded $1 million. Several deepwater tracts fetched $40+ million.

Then there's this, from BOEM's official press release under the title Obama Administration Holds 39-Million-Acre Oil and Gas Lease Sale in Central Gulf of Mexico:

As part of the Obama Administration’s all-of-the-above energy strategy, domestic oil and gas production has grown each year the President has been in office, with domestic oil production currently higher than any time in two decades and natural gas production at its highest level ever. Renewable electricity generation from wind, solar, and geothermal sources has doubled and foreign oil imports now account for less than 40 percent of the oil consumed in America – the lowest level since 1988.

… thus proving it possible to fit 20 pounds of bullcrap into a 10-pound paragraph. At the risk of repeating myself:

- Virtually all of the growth in oil and gas supply is due to private companies’ initiatives on state-controlled lands. Administration policies have been hostile to oil and gas on federal lands, as evidenced by declining production.

- “All-of-the-above” is not an Administration policy, it is a buzz-phrase they stole from Republicans because it tests well with focus groups. Obama would clearly like to shut down coal, is hostile to oil and ambivalent about natural gas.

- Renewable energy is used to generate electricity. Oil is predominantly a transportation fuel. Renewables do not replace oil imports. Repetition does not make it so.

North Dakota

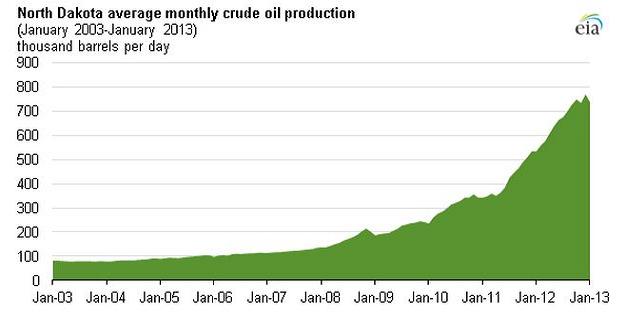

North Dakota crude oil production (including lease condensate) averaged an all-time high of 770,000 barrels per day in December 2012. Total annual production more than doubled between 2010 and 2012 through the use of horizontal drilling and hydraulic fracturing of deposits in the Bakken Formation in the Williston Basin. North Dakota production in 2012 trailed only Texas and the U.S. Federal Offshore region, and the state accounted for 10% of total U.S. crude oil production.

… [In] November 2012 North Dakota crude oil production fell slightly from the October level to 735,000 bbl/d because of weather-induced transportation problems caused by an unusually heavy snowstorm. Pipeline networks, which can be more efficient and less subject to storm disruptions than trucking, are currently being expanded. …

Because over 80% of North Dakota’s wells are located in only four counties—Dunn, McKenzie, Montrail, and William—in the northwest area of the state …, harsh weather in these areas can reduce the state’s total crude oil production, as happened in November 2012 and again in January 2013. (PennEnergy)

Think about it: North Dakota has surpassed the states you normally associate with oil, like Oklahoma, Alaska and Louisiana, and the boom has happened over a few short years.

The current issue of the National Geographic Magazine contains a cover article featuring development in the Bakken. It is worth checking out the hardcopy if only to see an impressive 2-page development map of the trend. (I must admit I have yet to read the article because NGM‘s take on things always skews to Global Warming alarmism.) But as to the economic impact on the state:

North Dakota is still in a position to parlay the boom into something lastingly beneficial. Of every dollar the oil industry earns, the state takes 11.5 cents, which produced revenues of more than two billion dollars from July 2011 to October 2012. One-third of that has been deposited in a permanent fund, the interest on which cannot be touched until 2017. The rest is to be divided between the state and local jurisdictions.

In discussions of “oil subsidies” (which relate to income tax treatment of mineral extraction), there is rarely discussion of severance taxes, which are essentially a direct tax on revenue, levied by most producing states, without regard to profitability.

Chevron overtakes Royal Dutch Shell

Earlier this year, Chevron Corporation (NYSE:CVX) quietly passed a milestone: it overtook Royal Dutch Shell plc (LON:RDSA) in terms of market capitalisation. With a market value of about $230bn compared with Shell’s $212bn, Chevron is on that measure the western world’s second-largest oil company, behind its US rival ExxonMobil Corporation (NYSE:XOM).

As George Kirkland, Chevron’s vice-chairman, admits, some “serendipity” has helped it reach that position. Its leaders have also made smart strategic choices: favouring oil production over gas; exploration for new fields over acquisitions, and ambitious capital spending over cautious husbanding of its financial resources.

Those decisions could make Chevron more vulnerable to a future collapse in the price of oil. For the time being, though, they are paying off. Of the five largest international oil companies – the other two are Total of France and BP – Chevron now has the highest earnings per barrel of production, and the best growth outlook. This week it reiterated with “increased confidence” its forecast that production would rise by 25 per cent by 2017, according to the Financial Times. (Offshore Technology International)

Two of the remaining Seven Sisters jockey for position. Chevron apparently bet heavier on oil vs natural gas, and the market is rewarding them.

Anadarko Drilling Success

Anadarko Petroleum Corporation (NYSE: APC) today [3/19] announced its Shenandoah-2 well in the deepwater Gulf of Mexico encountered more than 1,000 net feet of oil pay in multiple high-quality Lower Tertiary-aged reservoirs.

“The successful Shenandoah-2 well marks one of Anadarko’s largest oil discoveries in the Gulf of Mexico, with more than 1,000 net feet of oil pay and reservoir rock and fluid properties of much higher quality than previously encountered by industry in Lower Tertiary discoveries,” said Bob Daniels, Anadarko Sr. Vice President Deepwater and International Exploration. …

The Shenandoah-2 well, located in Walker Ridge block 51, was drilled to a total depth of 31,405 feet in approximately 5,800 feet of water, more than 1 mile southwest and approximately 1,700 feet structurally down-dip from the Shenandoah-1 discovery. Similar to the initial Shenandoah discovery well, log and pressure data from the Shenandoah-2 well indicate excellent-quality reservoir and fluid properties. The well was drilled to test the down-dip extent of the accumulation, and the targeted sands were full to base with no oil-water contact. (Marketwire/Anadarko Press Release)

Workforce Shortage

SAN ANTONIO, Texas — The energy industry is heading for a major shortage of skilled workers within a decade, an expert told members of the American Fuel and Petrochemical Manufacturers at its annual meeting here Tuesday.

There are about 4.5 million to 5 million skilled trade workers in the oil and gas industry in North America, and that’s down about a million from the mid 2000s, said Daniel Lumma, senior vice president of Kiewit Oil, Gas and Chemical North America in Houston.

Another “scary statistic,” he said, is that in 10 years, about half of the industry’s skilled trades workers will have retired.

All this is occurring as mega projects are underway or are on the drawing board.

Lumma cited Lake Charles, La., where planned projects include major gas-to-liquids facilities and perhaps five liquefied natural gas projects.

“If all of those projects happen, the peak workforce would have to multiply five to six times above what it is right now,” he said. “The fact is, that’s not going to happen.

“We’re heading into a very, very significant demographic issue.” (Fuelfix/Houston Chronicle)

Industry has been struggling with what it terms “The Big Crew Change” for a decade. Times were so bad in oil and gas from 1984-2004 that few young people pursued energy careers. As a result, there is a big bulge of Baby Boomers who currently run the industry, but who will reach retirement age within 10 years. The next younger cohort is below 35.

The highlighted article mainly deals with large-scale facility production projects planned to take advantage of low prices of natural gas relative to oil; currently over $60 billion in new construction is in the planning phase in Louisiana alone. I’m skeptical whether the qualified manpower for so many large projects will be available at any price.

Cross-posted at stevemaley.com.

Join the conversation as a VIP Member