This is the first of a series on the issue of global trade and the politics and economics surrounding tariffs and trade.

Since the birth of America, tariffs have had a significant impact on the American economy. Tariffs have a formative effect on trade policy and have sparked contentious debates regarding protectionism and free trade. Throughout history, the United States has enacted and adjusted the level of tariffs in response to a variety of factors, such as protecting national security, fostering economic protectionism, as well as addressing so-called trade imbalances.

The Smoot-Hawley Tariff Act of 1930, signed into law by Herbert Hoover, which is linked to the 1929 stock market crash, stands out as a tariff law that had an enduring impact on the American economy, not to mention the American psyche. Economists still debate its relationship to the 29 crash, and what role it played with respect to the Great Depression.

Implementation of tariffs followed the country's Declaration of Independence. The Tariff Act of 1789 was passed by the first Congress in 1789, during George Washington's presidency. As the United States' economy grew during the 19th century, protectionist sentiments increased noticeably.

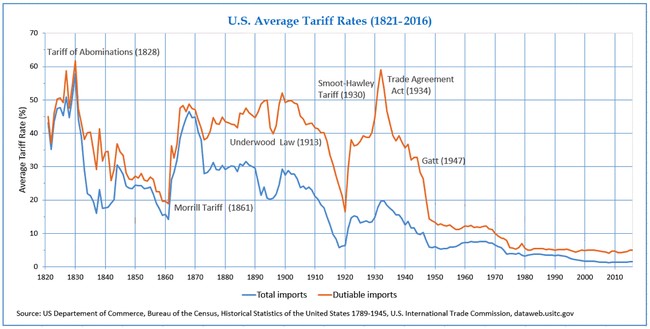

The Tariff Act of 1828, also known as the Tariff of Abominations, generated considerable controversy. The primary objective of this policy was to protect American manufacturers from the threat of competition posed by cheaper British products. However, implementation of the 1828 Tariff Act had a disproportionate effect on Southern states that primarily relied on imported commodities.

The 1828 Tariff Act resulted in widespread discontent and ultimately contributed to the Nullification Crisis, which prompted discussions regarding the balance of power between the 24 states and the federal government.

The issue of nullification divided the White House as Vice President Calhoun staunchly supported states’ rights and served as a spokesman for nullification by revealing he wrote “Exposition and Protest.” Jackson, on the other hand, supported states’ rights, but not at the expense of the Union and once stated he “would rather die in the last ditch than see the union dismantled.” The Nullification Crisis was one in a series of issues that destroyed Jackson and Calhoun’s relationship. - Article from American Battlefield Trust

In March of 1861, during the Civil War, as one of his final acts as President, James Buchanan signed the Morrill Tariff Act, which imposed higher duties on imported goods for the dual purposes of protecting Northern industries and generating revenue to help underwrite the war effort. Additional tariff increases under the Morrill Act were signed into law by Abraham Lincoln, and tariffs remained high throughout the duration of the Civil War.

Following the conclusion of the war, reducing tariffs to stimulate trade and facilitate economic recovery took on new support, although tariffs remained high until the Underwood Tariff of 1913.

In the early part of the 20th century, taxes and tariffs emerged as a central component of economic policy. Under the administration of President Woodrow Wilson, one of his first priorities was signing the Underwood-Simmons Tariff Act of 1913, which, in addition to re-establishing a federal income tax, also substantially reduced tariffs.

However, as a result of the outbreak of World War I in 1914, the United States shifted once more towards protectionist policies designed to safeguard local businesses and ensure a steady flow of products throughout the global conflict. In this particular setting, the Smoot-Hawley Tariff Act came into existence.

In the early phases of the Great Depression, Senator Reed Smoot and Representative Willis C. Hawley introduced a bill designed to protect American farmers and industries from the negative effects of foreign competition. The legislation imposed a substantial increase in duties on more than 20,000 imported products, making it one of the most stringent tariff measures in U.S. history.

However, the Smoot-Hawley Tariff Act had unanticipated consequences. Numerous nations responded by imposing reciprocal tariffs on American goods, thereby sparking a global trade war and precipitating a significant decline in global trade. The effect on American exports was significant, resulting in a decline in revenue for farmers and businesses and exacerbating preexisting economic difficulties.

In addition, the Smoot-Hawley Tariff Act is sometimes linked to the 1929 stock market collapse, but the extent of its direct influence on the catastrophe is still a matter of debate.

According to historians and economists, multiple variables, including speculative activities, excessive output, and a vulnerable financial infrastructure, interacted in complex ways to cause the stock market collapse. The adoption of higher tariffs, in addition to the income tax, exacerbated economic conditions and global trade, leading to a decline in the global economy.

The negative effects of the tariff legislation were significant on an economy that was already in decline. In response to the prevalent economic downturn, nations resorted to instituting their own protectionist policies, thereby diminishing global trade and further exacerbating the global economic downturn.

The United States' Gross Domestic Product (GDP) experienced a significant decline from $103.6 billion in 1929 to $56 billion in 1933. This decline in economic output coincided with a significant rise in unemployment rates. Economists generally agree that the Smoot-Hawley Tariff Act exacerbated the severity and prolonged the duration of the Great Depression.

In response to the knowledge acquired through the Smoot-Hawley Tariff Act, subsequent administrations adopted more liberal trade policies, including lowering tariffs.

The Reciprocal Trade Agreements Act of 1934 authorized the President to negotiate with foreign nations for reduced tariff rates. This legislation ultimately paved the way for the 1947 establishment of the General Agreement on Tariffs and Trade (GATT), which aimed to promote global trade by reducing barriers to international commerce.

The General Agreement on Tariffs and Trade (GATT) evolved into the World Trade Organization (WTO) in 1995 after undergoing a transformation over time. Currently, the WTO is responsible for overseeing international trade discussions and resolving trade disputes.

Tariffs have been a conspicuous aspect of American trade policy throughout its entire historical progression. The Smoot-Hawley Tariffs are perhaps the most prominent example of the consequences of protectionist measures enacted during a period of economic decline, as argued by Jude Wanniski in his book “The Way the World Works” and also in a 2001 “Memo on the Margin":

In the course of researching and writing The Way the World Works in 1977, I discovered that the cause of the 1929 Wall Street Crash was the emerging Smoot-Hawley Tariff Act, a fiscal event, not a monetary event. That is, when the tariff wall went up between domestic and foreign producers, inventories accumulated on both sides of the wall and prices had to fall for those inventories to be liquidated. There would have been a short recession, but to recover lost revenues, President Herbert Hoover raised the top income tax rate to 63% from 25%. This made it far more difficult for producers to exchange goods over the domestic tax wall. President Franklin Roosevelt made the situation worse by raising the top rate to 91% and hiking the capital gains tax.

Although the precise extent of its impact on the 1929 stock market collapse remains a matter of debate, there is widespread agreement that the Great Depression was exacerbated by the escalation of international trade tensions and serves as a warning to policymakers and legislators in Washington: At first, do no harm. (To be continued...)