I’m neither a constitutional scholar nor a tax attorney, but as a 30-year professional money manager and tax-planning guy, I can’t see how Joe Biden’s non-income-based Billionaire Tax comes even close to being constitutional. Not that constitutionality has ever phased the woefully inept president, but I’m just sayin’.

While Biden’s plan to squeeze billionaires will be DOA in Kevin McCarthy’s Republican-controlled House, it’s worthy of discussion, for the simple reason that if the Democrats end up with control of both chambers and the White House after the 2024 election, hello billionaire tax.

Which reminds me: 2024 will arrive soon enough; let’s not screw it up. But I digress.

Anyway, here’s how Biden’s proposed Billionaire Tax would work, as reported by CNBC:

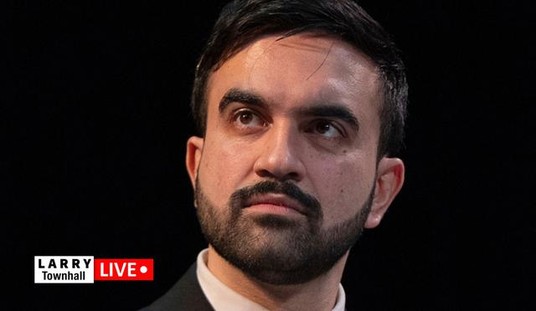

Jared Bernstein, a member of the White House Council of Economic Advisers, said Biden’s tax proposal will target big corporations and the wealthiest Americans while protecting taxpayers who earn $400,000 a year or less from tax hikes.

“The days of the top 1% paying less than teachers and nurses … those have got to be behind us as we inject fairness into the tax code to achieve fiscal rectitude,” Bernstein said in an interview Wednesday on CNBC’s “Squawk Box.”

[…]

During his State of the Union address … Biden urged Congress to pass his so-called billionaire’s tax, which proposes to impose a minimum 20% tax on households with a net worth of more than $100 million — a 12 percentage point increase from an average of 8% they currently pay.

Bernstein also defended the president’s tax rate on capital gains, which he initially proposed in 2021. If enacted, the 48.6% rate with a 3.8% net investment income on long-term capital gains and qualified dividends would rate among the highest in the developed world.

The tax rate would apply to those earning over $1 million.

Incidentally, before I forget, let’s address the Democrats’ ridiculous “fair share” fallacy, a phrase made infamous by Chicago Jesus Barack Obama throughout his presidency, ad nauseam:

The top 1 percent of earners paid 42.3 percent of all federal taxes in 2020, according to the Tax Foundation, which raises the question of whether the wealthiest Americans “pay lower taxes than teachers and firefighters,” as Biden consistently lies. If anything, my Democrat friends, 42.3 percent of federal taxes paid by 1 percent of earners amounts to a grossly unfair share.

Simply, Biden’s “billionaire minimum tax” of 25 percent would apply to “appreciated assets,” or a tax on unrealized capital “gains.” Presently (and “forever”), if you own a stock that increases in value, you are only taxed on that increase in value if and when you sell the stock.

But by taxing unrealized capital gains (capital appreciation), Biden’s billionaire tax would tax rich people on their hypothetical increases in wealth even though they haven’t actually sold the stocks and cashed in on them, or yet realized a gain. Moreover, given that stocks are variable assets, they not only increase in value, but they also decrease in value, as well.

So why invest in variable investments? Because, as history has shown us, stock market indices have increased in value over a period of years — just not in a straight line. As I explained to my investment clients, picture a child playing with a yo-yo while riding up an escalator. The yo-goes up and down, but the up-escalator only goes up.

That’s the strategy, but history has also shown us that bad things sometimes happen to some stocks, so there ain’t no free lunch, or guaranteed return — particularly if or when an investor sells a holding before originally anticipated — and takes a capital loss.

I’m probably too far off in the weeds, but the potential fly in Biden’s billionaire ointment is if unrealized capital gains (capital appreciation) are taxed, and then the investment decreases in value, the following year. Joe? How would that work in your money grab? Regardless, as I said at the top, I can’t see how Biden’s scheme could be anything but unconstitutional.

As economic historian Phil Magness explained for the American Institute for Economic Research, the Constitution does give Congress the power to levy taxes, but direct taxes must be apportioned among the states relative to population. (Biden’s proposal fails to do so.)

Biden’s proposed wealth tax will also likely face another obstacle: it is blatantly unconstitutional.

To see how, we must turn to the text of the Constitution itself. Article I, Section 8 of the document establishes the “Power to lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States” with the stipulation that these measures must be uniform.

A separate clause in Article 1, Section 9 stipulates that “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.”

“Much like the contrived economic arguments behind the wealth tax, its legal arguments are a result of politically motivated reasoning to bring about a new tax system that the Constitution prohibits,” Magness added. He concluded:

If Biden gets his tax, it would face a steep and immediate constitutional challenge. The administration is likely banking on a series of extremely tendentious arguments by far-left law professors to argue that previous jurisprudence on this question should be discarded.

These arguments often … openly advocate judicial activism from the bench, as a strategy to bypass the apportionment requirement through semantic games. Even supporters of the idea concede that this strategy is unlikely to pass muster with the current Supreme Court.

And how much of any of the above does Joe Biden even come close to understanding?

All together now: ZERO.

Join the conversation as a VIP Member